The hurdles that emerge during the sale of a business are enough to test even seasoned entrepreneurs. From securing accurate valuations to ongoing negotiations, business owners grapple with the intricate dance of preserving the legacy they’ve spent years building while ensuring a smooth transition for their family, their employees, and the incoming custodian of the business.

Even with years of planning for the future, there are questions that arise after the close:

- How will capital proceeds be deployed?

- Should I have wealth-related privacy concerns?

- How will the increased complexity of my personal finances be handled?

- Do I have the right team of advisors to support endeavors moving forward?

- What’s the impact on my family?

- Should I be thinking about family venture capital to support certain projects and governance structures?

Fear Equals Opportunity

Owners face both the business planning and emotional and personal planning implications of the sale. This raises questions and fears around identity, lifestyle, long-term goals, family, and legacy. “The potential impact on family is one of the most common challenges a business owner faces during the transition,” according to Colten Christianson, a principal who leads a team responsible for collaborating with closely held business owners.

Let’s explore how to navigate some common fears.

Fear 1: Change Management

“Business owners are very intentional about the value creation of their business. They aren’t very intentional about the value creation of their wealth as a family operator,” says Justin Fisher, a principal, lead of Moss Adams Wealth Advisors, and seasoned financial planner who works closely with business owners, individuals, and their families.

Moving from business to personal value is a mentality switch that can feel abrupt for business owners.

Fear 2: Confronting Common Misconceptions

“When a business owner completes a sale, the family business wealth is now the business operation. With so much happening during that transformation, it can feel overwhelming,” says Fisher. “One common misconception is to spread money across multiple entities to create diversification. Entity diversification doesn’t create value; it creates inefficiencies with your wealth.”

Fisher encourages a holistic team approach—including tax, estate, and financial planning considerations. “If you have several people managing accounts that are both buying and selling securities, you’re complicating tax reporting, increasing costs, and creating a competitive environment instead of a holistic partnership.

In today’s marketplace, owners are looking for advisors who can offer the integrated capabilities of tax filings and planning, investments, wealth management, financial planning, and family office capabilities.”

Fear 3: What Comes Next?

Once the sale closes, being without the daily rigors of entrepreneurship triggers a unique set of questions about the next chapter of life and future goals.

Those goals can range from starting a new business to pursuing personal passions put on hold during business ownership.

Owners may also face the psychological challenge of going from being a pillar of the community to finding a new purpose.

Fear 4: Succession Planning

Family legacy and family dynamics are concerns that weigh heavily during this process.

Business owners will take on the intricate task of structuring the family’s future, contemplating the best avenues for estate planning, philanthropy, and gifting assets to heirs.

This delicate balance between preserving a family legacy and avoiding the pitfalls of excessive wealth creates a formidable challenge, says Christianson. “One of the most common issues that arises is about impact, family legacy, and being measured when it comes to gifting assets to heirs and children. It’s a common fear and one we address right away.”

The fear of making the wrong choice, compounded by financial windfall, adds another layer of complexity to the post-sale narrative. The overarching goal is to identify financial, tax, and estate opportunities for any life event.

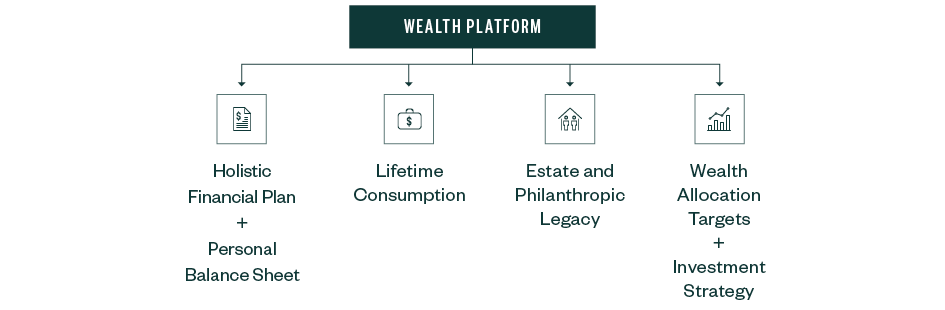

Create a Platform for Wealth

Crafting a holistic financial plan that aligns with your goals is a vital step in creating a true platform for wealth. This platform extends its support to fostering family financial literacy and instilling a sense of purpose in every financial decision.

This approach helps to elevate your wealth management into a purposeful and impactful endeavor.

Platform for Wealth

Build a Holistic Financial Plan and Detailed Personal Balance Sheet

It’s critical to forecast a personal balance sheet with the meticulous attention once devoted to business finances. This includes a comprehensive analysis of assets, liabilities, and long-term financial goals.

This holistic view enables a clear understanding of the new financial landscape, allowing for more informed decisions and sustained wealth management.

Understand Lifetime Consumption

Determining how much liquidity and cash flow is needed to meet lifetime consumption or spending goals is essential. From there, you can better understand how your balance sheet can support those goals over time.

Align on Estate and Philanthropic Legacy

A transaction often creates opportunities for estate planning and philanthropic or charitable giving, particularly if a deal nets liquidity beyond what’s needed for lifetime consumption.

Recognizing that wealth management isn’t a solitary endeavor, the next pillar of the plan focuses on engaging family members in financial literacy.

This includes imparting a nuanced understanding of the family’s financial legacy and how to navigate the responsibilities that come with it. Educational initiatives, family discussions, and collaboration with advisors form the bedrock of this engagement.

Set Wealth Allocation Targets and Execute on Investment Strategy

This meticulous process outlines an intricate roadmap for resource allocation to help determine the appropriate risk profile and investment strategy for each of the following buckets:

- Personal consumption

- Aspirational

- Philanthropic or charitable

- Gifting to heirs or multigenerational family members

Each bucket will have different goals and objectives that drive the underlying strategy. This provides a delicate balance between meeting immediate lifestyle needs and fostering sustained long-term financial growth.

By seamlessly integrating lifestyle aspirations with long-term financial objectives, this roadmap transforms the post-sale narrative into a journey of purposeful wealth creation, where every financial decision contributes to a fulfilling and sustainable future.

Colten Christianson, CFP®, Moss Adams Wealth Advisors, colten.christianson@mossadams.com

Justin Fisher, CFP®, Moss Adams Wealth Advisors, justin.fisher@mossadams.com

Colten Christianson comes from a family business himself, and since 2011 has worked closely with business owners and their families to prioritize their goals. He assists owners through every stage of the business lifecycle, from owning and operating the business to transitions.

Justin Fisher is the leader of Moss Adams Wealth Advisors. Since 2006, he has worked closely with business owners, individuals, and their families in prioritizing their unique goals and customizing integrated wealth management strategies.

Baker Tilly is a leading assurance, tax and advisory firm that provides a comprehensive range of professional services to businesses and individuals. We protect and enhance our clients’ value through innovation, forward-thinking strategies and a trailblazing mindset. The result is a tailored pathway to success for each of our clients.

Family Business Partner Content

Family Business Partner Content

This content is made possible by our partner and is independent of Family Business Magazine’s Editorial Staff

Baker Tilly US, LLP, Baker Tilly Advisory Group, LP and Moss Adams LLP and their affiliated entities operate under an alternative practice structure in accordance with the AICPA Code of Professional Conduct and applicable laws, regulations and professional standards. Baker Tilly Advisory Group, LP and its subsidiaries, and Baker Tilly US, LLP and its affiliated entities, trading as Baker Tilly, are members of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. Baker Tilly US, LLP and Moss Adams LLP are licensed CPA firms that provide assurance services to their clients. Baker Tilly Advisory Group, LP and its subsidiary entities provide tax and consulting services to their clients and are not licensed CPA firms. ISO certification services offered through Moss Adams Certifications LLC. Investment advisory offered through either Moss Adams Wealth Advisors LLC or Baker Tilly Wealth Management, LLC. ©2025 Baker Tilly Advisory Group, LP.