A New Operating Model for Family Businesses

Building a successful business is only half the equation. Sustaining wealth, alignment and leadership across generations is the real test.

For business-owning families, the challenge isn’t just financial performance — it’s aligning money with lifestyle priorities, leadership readiness and long-term continuity. Too often, traditional financial planning falls short of addressing the complex realities families face at moments of growth, transition and succession.

Date and Time

Thursday, February 26, 2026

2 PM ET | 11 AM PT

60 minutes

This webinar introduces a modern, family-centered operating model that reframes wealth beyond balance sheets — helping families make better decisions, strengthen resilience and preserve what truly matters across generations.

In this session, you’ll learn how to:

- Apply the Lifestyle, Liquidity and Legacy framework to make clearer, more confident decisions that support both the family and the enterprise.

- Understand why conventional financial advice often misses the mark for founders and multigenerational families — and how a purpose-driven approach better aligns wealth, leadership development and shared values.

- Use this model to navigate growth, transition and succession with greater clarity, control and flexibility.

This conversation surfaces the questions many families avoid, but can’t afford to ignore: how personal and relational dynamics influence business decisions, where liquidity truly creates or limits optionality and whether families are passing on not just assets, but the decision-making frameworks and leadership capacity needed for the future.

Join Susan Cruz, Vice President and Private Wealth Senior Relationship Manager at Merrill Lynch; Derek Jancisin, Managing Director and Private Wealth Advisor at Merrill Lynch; along with David Shaw, Publishing Director of Family Business Magazine, for a practical, forward-looking discussion designed to help business-owning families move beyond business wealth and build enduring family wealth.

Speakers

Susan Cruz

Vice President and Private Wealth Senior Relationship Manager, Merrill Lynch

“I never want to retire.”… is what Susan often hears from the business owners she works with. She says, “I’ve never met a business owner who wants to go to the beach or golf 7 days a week, either”. They’ve already built significant wealth and a lifestyle that revolves around owning and operating a successful business. They have full autonomy. But there is something missing… This is what Susan calls the “Preferment Stage”. Every business owner reaches this place. This is the moment they realize they’d like to start doing more of the things they prefer… That may be getting involved in community affairs…spending more time coaching children or grandchildren in sports…maybe traveling more frequently… pursuing a new business venture…etc. But they’re unable to explore these opportunities… They are held back by questions like: “Can I take time off from being IN my business?” “Can I…or should I…sell my business now?” “What is my business worth today? Is it enough to live on?” “Is my wealth positioned to grow as I begin to work less?” Helping clients answer these questions is what Susan calls fun! It is all about creating clarity and opportunity out of uncertainty for clients! Susan joined Merrill in 1983.

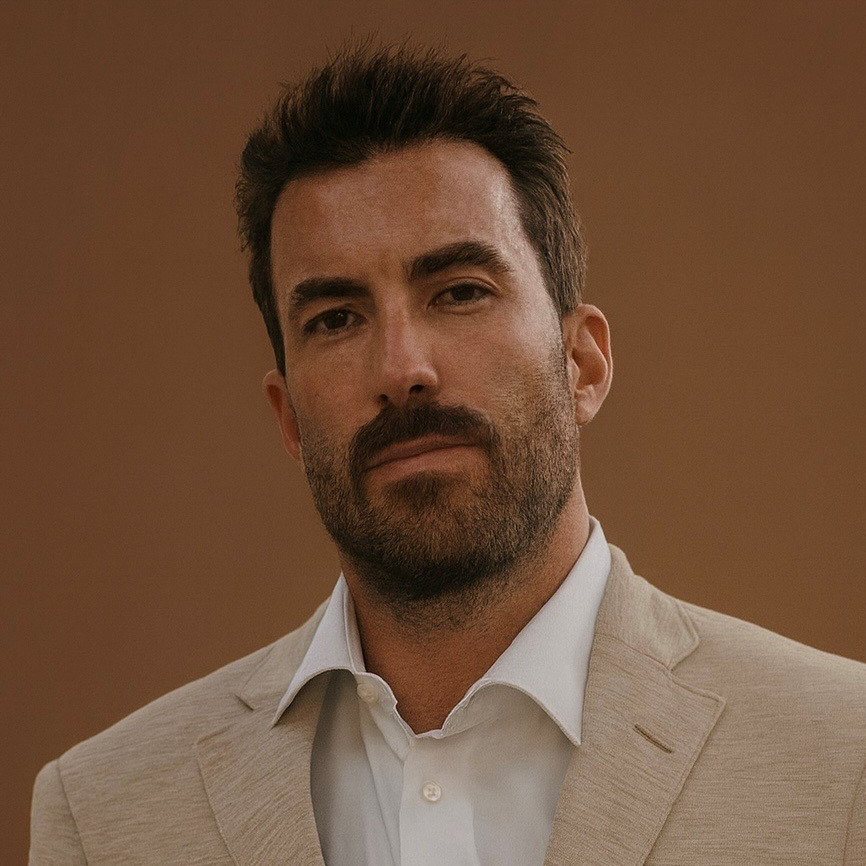

Derek Jancisin

Managing Director and Private Wealth Advisor, Merrill Lynch

Derek began his career at Merrill in 2010, joining his mentor and father, David Jancisin. Having grown up immersed in the business through his father’s advisory practice, Derek developed an early respect for the impact thoughtful planning can have across generations—refining his own approach through hands-on experience and a passion for solving complex planning puzzles.He is a Managing Director and a Private Wealth Advisor. Today, he serves as Senior Partner of Jancisin | DiSilvio, leading a multigenerational team that delivers institutional-level wealth management to individuals, families and organizations with complexity. Derek specializes in creative, forward-thinking planning strategies—particularly around business transitions and legacy—helping clients bring clarity and intention to otherwise complicated situations. Driven by a mission to simplify complexities and make a lasting impact, Derek focuses on understanding what truly matters to each client before crafting strategies. His approach blends technical expertise with elevated experiences, creating an advisory relationship that is both strategic and meaningful. A lifelong learner, Derek continues to pursue advanced education in financial planning, and business succession. But it’s his real-world experience—working shoulder-to-shoulder with business owners, executives and next-generation leaders within families—that he believes gives him his edge. Outside the office, Derek stays energized through golf, aviation, fitness and travel. He’s passionate about excellence, both personally and professionally, and views each client relationship as an opportunity to help someone live—and leave—a better story.

David Shaw

Publishing Director, Family Business Magazine

David Shaw is the publishing director for MLR Media. He also co-founded and serves as conference director of the Transitions conferences, the Private Company Governance Summit and Family Business Legacy.

David writes frequently on governance issues for public and private companies, and develops and maintains close relationships with multi-generational family-owned businesses. He is married, with two grown children.

Benefits

- No cost to attend.

- Opportunity for questions and feedback.

- Unbiased third-party family business education.

- All participants can receive a copy of the webinar materials after the event, upon request.

- All participants receive Family Business Magazine weekly newsletter, with news, tips and trends that impact your family business. You may, of course, opt out at any time.

- 60 minutes — maximum value for time.

Sponsored by